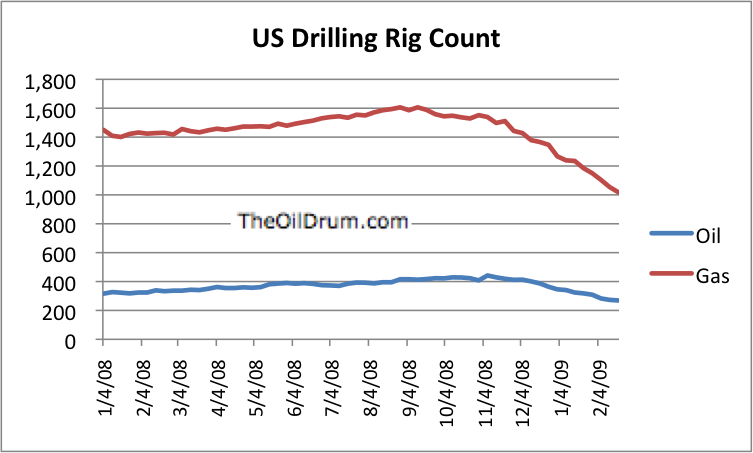

The oil and gas industry is already pulling back sharply. If one looks at drilling rig counts, the number of drilling rigs operating in the United States has dropped by close to 40% from peak levels in 2008. Now changes to the tax law which would make it more expensive for oil and gas companies to operate are being proposed by the Obama administration.

What is the likely outcome? I fear it is an even steeper drop in US produced oil and gas supplies than would otherwise be the case. This drop will come primarily because of the likely impact on small oil and gas companies that dominate the US production market, especially for natural gas.

I have read that Speaker Nancy Pelosi and Senate Majority Leader Harry Reid are asking that the Capitol Power Plant change from coal to natural gas for producing electricity. With the proposed tax policy, I am afraid that they will find themselves asking to switch back to coal within a few years, because sufficient natural gas will not be available. If the natural gas industry is to maintain or raise production levels, it will need assistance, not higher taxes. ..

According to recent testimony of Gary Luquette, President of Chevron North America Exploration and Production Company, the industry spent $152 billion on tax and royalty revenues paid to federal, state, and local governments. This averages about $25 billion a year. If the tax amounts to only $3.15 billion a year, this would amount to a 12% increase. Of course, it is not clear it will come to only $3.15 billion a year--it may be considerably more. ...

If the Obama Administration expects natural gas to replace some of the coal currently in use, it needs to be careful in crafting its tax legislation not to penalize the many small companies that today produce natural gas and oil.

One aspect of Obama's plan would levy an excise tax on Gulf of Mexico oil and natural gas, which would raise $5.3 billion in revenue from 2011 to 2019. This new 13 percent tax on production in the Gulf would only affect companies not currently paying any royalties. A $4-an-acre annual fee on non-producing Gulf leases would generate $1.2 billion from 2010 to 2019.

Read full here at The Oil Drum