While Krugman's exact words are that peak oil has arrived... not only are we no better off now than in the first peak oil warnings of the 70's, we are in a far worse situation. Our worlds energy use forecast is built and projected based on in increased use of fossil fuels and the EIA thinks oil will not hit $100 a barrel until 2017.

Do they also think the world is flat?

From TOD - We no longer have to worry about energy supply or prices.

From TOD - We no longer have to worry about energy supply or prices. That is the message from the U.S. Energy Information Administration's (EIA) Annual Energy Outlook (AEO) 2011. Cheap energy will characterize the world for most of the next decade, according to the report.

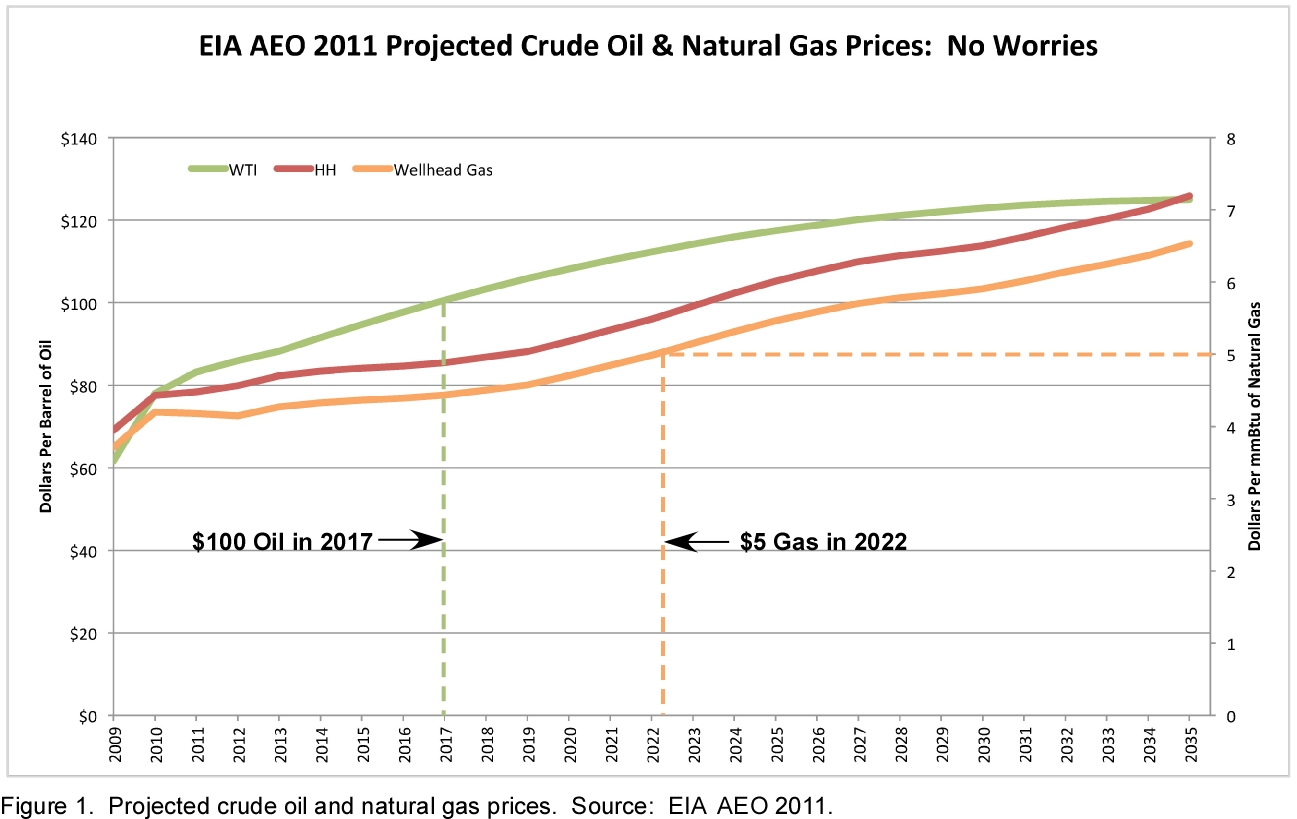

Oil will not reach $100 per barrel until 2017 and natural gas will remain below $5 per thousand cubic feet (mcf) until 2022 (Figure 1).

From NY times: peak oil has arrived. True, alternative sources, like oil from Canada's tar sands, have continued to grow. But these alternative sources come at relatively high cost, both monetary and environmental...So what are the implications of the recent rise in commodity prices?

It is, as I said, a sign that we're living in a finite world, one in which resource constraints are becoming increasingly binding. This won't bring an end to economic growth, let alone a descent into Mad Max-style collapse. It will require that we gradually change the way we live, adapting our economy and our lifestyles to the reality of more expensive resources.

The timeline of transition:

Why peak hit before 2030 - As new sources dwindle between 2011-15 India and china will require twice the capacity of current supplies by 2020.

Update (Gas2.0)

Last week, gas prices hit $3 a gallon nationwide, and $4 a gallon gas seems inevitable this summer. Now the former president of Shell Gasoline says that by the summer of 2012, gas could cost $5 a gallon. Yikes.

Former Shell President John Hofmiester told Platts Energy Weekly television that by 2012, Americans could be paying, on average, $5 a gallon for gas, even without a gas tax hike.

Why so high, so soon?

Oil consumption in the U.S. imploded in 2008, 2009, and 2010 (link)

Oil consumption around the world suffered a severe decline in the third quarter of this year (link)

Oil consumption around the world suffered a severe decline in the third quarter of this year (link)

OPEC has stated that there is no supply shortage and that wells will run at current capacity. The data seems to support their claim. There is no scarcity of oil, and demand has only fallen over the past three years. So, what is causing crude values to rocket towards $100 a barrel?

Hint - Currency Devaluation.