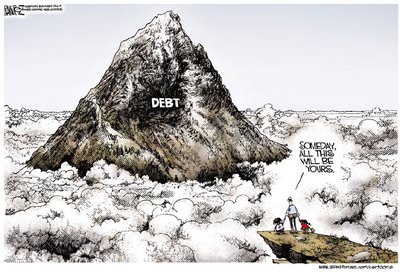

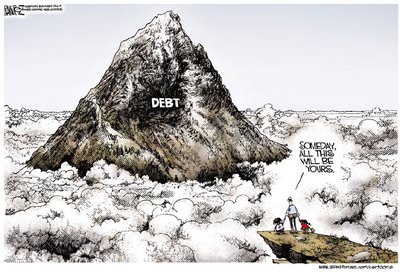

"If bankruptcy is the cure for Greece, is it also the cure for the United States?"

"Absolutely," Ron Paul replied...no fan of the Federal Reserve either, and suggested Monday the United States should eliminate the Fed as a way to reduce the deficit. "We owe, like, $1.6 trillion because the Federal Reserve bought that debt, so we have to work hard to pay the interest to the Federal Reserve," Paul said. "We don't, I mean, they're nobody; why do we have to pay them off? On the debt ceiling, Paul said the most likely scenario is that lawmakers pass a series of short-term increases of the nation's borrowing limit. And he said that if the U.S. were to wipe out the debt owed the Fed, investors would gain confidence. "They'll say 'Hey, they've just reduced the deficit by over a trillion dollars, now they can handle it. They can go back to meeting their other obligations,' " Paul said. "It might give some reassurance to the market." Read full By Charles Riley So why does the Federal Reserve keep saying that inflation is not a major worry at this time?

"We owe, like, $1.6 trillion because the Federal Reserve bought that debt, so we have to work hard to pay the interest to the Federal Reserve," Paul said. "We don't, I mean, they're nobody; why do we have to pay them off? On the debt ceiling, Paul said the most likely scenario is that lawmakers pass a series of short-term increases of the nation's borrowing limit. And he said that if the U.S. were to wipe out the debt owed the Fed, investors would gain confidence. "They'll say 'Hey, they've just reduced the deficit by over a trillion dollars, now they can handle it. They can go back to meeting their other obligations,' " Paul said. "It might give some reassurance to the market." Read full By Charles Riley So why does the Federal Reserve keep saying that inflation is not a major worry at this time?

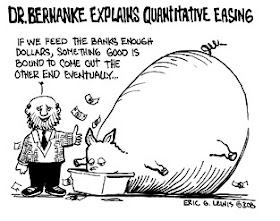

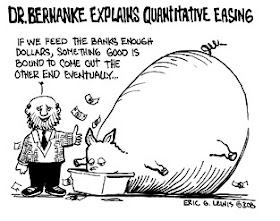

The main goal of the nation’s central bank right now is to make sure that the economy keeps gaining strength and that unemployment drops -- and to worry about soaring prices later -- so it plays a game of semantics. Even though inflation is up, the Federal Reserve uses a special statistic, known as the Core Consumer Price Index, which doesn’t include prices of food and energy, to decide when to raise interest rates... Meanwhile, the Federal Reserve’s efforts to save the economy with cheap money has been worth billions of dollars to banks and mortgage borrowers, but it’s been brutal for savers and retirees living on fixed incomes who are hurt by low interest rates. Social Security recipients have gone two straight years with no increase in cost-of-living benefits. The yields on cash in money-market funds have been near zero, and a six-month certificate of deposit (CD) yields a national average of just 0.29%. The Inflation Time Bomb Is Ticking

Meanwhile, the Federal Reserve’s efforts to save the economy with cheap money has been worth billions of dollars to banks and mortgage borrowers, but it’s been brutal for savers and retirees living on fixed incomes who are hurt by low interest rates. Social Security recipients have gone two straight years with no increase in cost-of-living benefits. The yields on cash in money-market funds have been near zero, and a six-month certificate of deposit (CD) yields a national average of just 0.29%. The Inflation Time Bomb Is Ticking

Why have food and energy prices risen so sharply?

The trend has been driven by a "perfect storm" of factors -- political unrest in the Middle East has led to spiking crude oil prices... violent weather patterns, including floods in Australia and drought in China, have decreased the global crop supply... recovering economies have increased worldwide demand... plus our own government has set the stage for higher prices. Since 2008, the US Federal Reserve has kept short-term interest rates near zero and purchased hundreds of billions of dollars’ worth of US Treasury bonds, flooding the economy with money in an effort to stimulate economic growth and reduce unemployment. When will inflation really hit us, and how bad could it get?

If Federal Reserve Chairman Ben Bernanke makes all the right moves at the right time, the economy’s growth will accelerate and annual inflation will be around 2%. Congress will be able to pare the budget deficit, and Bernanke will be able to wait until after the presidential election in 2012 or beyond to slowly start raising interest rates. Read more of this interview with Irwin Kellner, PhD, one of the nation’s most respected economists, about the inflation time bomb we’re seeing down the road and how it’s likely to affect you...

"Absolutely," Ron Paul replied...no fan of the Federal Reserve either, and suggested Monday the United States should eliminate the Fed as a way to reduce the deficit.

"We owe, like, $1.6 trillion because the Federal Reserve bought that debt, so we have to work hard to pay the interest to the Federal Reserve," Paul said. "We don't, I mean, they're nobody; why do we have to pay them off? On the debt ceiling, Paul said the most likely scenario is that lawmakers pass a series of short-term increases of the nation's borrowing limit. And he said that if the U.S. were to wipe out the debt owed the Fed, investors would gain confidence. "They'll say 'Hey, they've just reduced the deficit by over a trillion dollars, now they can handle it. They can go back to meeting their other obligations,' " Paul said. "It might give some reassurance to the market." Read full By Charles Riley So why does the Federal Reserve keep saying that inflation is not a major worry at this time?

"We owe, like, $1.6 trillion because the Federal Reserve bought that debt, so we have to work hard to pay the interest to the Federal Reserve," Paul said. "We don't, I mean, they're nobody; why do we have to pay them off? On the debt ceiling, Paul said the most likely scenario is that lawmakers pass a series of short-term increases of the nation's borrowing limit. And he said that if the U.S. were to wipe out the debt owed the Fed, investors would gain confidence. "They'll say 'Hey, they've just reduced the deficit by over a trillion dollars, now they can handle it. They can go back to meeting their other obligations,' " Paul said. "It might give some reassurance to the market." Read full By Charles Riley So why does the Federal Reserve keep saying that inflation is not a major worry at this time?The main goal of the nation’s central bank right now is to make sure that the economy keeps gaining strength and that unemployment drops -- and to worry about soaring prices later -- so it plays a game of semantics. Even though inflation is up, the Federal Reserve uses a special statistic, known as the Core Consumer Price Index, which doesn’t include prices of food and energy, to decide when to raise interest rates...

Meanwhile, the Federal Reserve’s efforts to save the economy with cheap money has been worth billions of dollars to banks and mortgage borrowers, but it’s been brutal for savers and retirees living on fixed incomes who are hurt by low interest rates. Social Security recipients have gone two straight years with no increase in cost-of-living benefits. The yields on cash in money-market funds have been near zero, and a six-month certificate of deposit (CD) yields a national average of just 0.29%. The Inflation Time Bomb Is Ticking

Meanwhile, the Federal Reserve’s efforts to save the economy with cheap money has been worth billions of dollars to banks and mortgage borrowers, but it’s been brutal for savers and retirees living on fixed incomes who are hurt by low interest rates. Social Security recipients have gone two straight years with no increase in cost-of-living benefits. The yields on cash in money-market funds have been near zero, and a six-month certificate of deposit (CD) yields a national average of just 0.29%. The Inflation Time Bomb Is Ticking- The prices of cotton and corn have more than doubled in the past year.

- Sugar is up 60% and wheat, 55%.

- Silver prices have gained more than 50% and copper, 36%.

- At the gas pump, it costs 30% more to fill up than it did one year ago.

- US energy prices rose by 3.4% this past February alone, and another 3.5% in March.

- Food prices at the wholesale level rose by the most in 36 years,

- Chocolate bars, cereals, cold cuts, ice cream, tuna and even ketchup, toilet paper and spices such as garlic powder and black pepper have jumped in price or their package sizes have shrunk.

Why have food and energy prices risen so sharply?

The trend has been driven by a "perfect storm" of factors -- political unrest in the Middle East has led to spiking crude oil prices... violent weather patterns, including floods in Australia and drought in China, have decreased the global crop supply... recovering economies have increased worldwide demand... plus our own government has set the stage for higher prices. Since 2008, the US Federal Reserve has kept short-term interest rates near zero and purchased hundreds of billions of dollars’ worth of US Treasury bonds, flooding the economy with money in an effort to stimulate economic growth and reduce unemployment. When will inflation really hit us, and how bad could it get?

If Federal Reserve Chairman Ben Bernanke makes all the right moves at the right time, the economy’s growth will accelerate and annual inflation will be around 2%. Congress will be able to pare the budget deficit, and Bernanke will be able to wait until after the presidential election in 2012 or beyond to slowly start raising interest rates. Read more of this interview with Irwin Kellner, PhD, one of the nation’s most respected economists, about the inflation time bomb we’re seeing down the road and how it’s likely to affect you...