|

| Todays Run Cash "Dash to the Crash" |

activistpost - If you're a baby boomer who still believes in the stock market since the financial collapse of 2008, listen up. The floor of this Ponzi scheme is

The largest companies in three of the most important leading sectors of the market have seen their executives classified as insiders sell more than 120 million shares of stock over the last six months. Top executives at these very same companies bought just 38,000 shares over that same time period, making for an eye-popping sell to buy ratio of 3,177 to one.

The grand total for the three sectors are "as awful as we have ever seen since we began doing this exercise years ago," said Newman, who was ahead on such trends as the dangers of high-frequency trading and ETFs before the 'Flash Crash'. "Clearly, insiders are seeing great value only in cash. Their actions speak volumes for the veracity for the current rally."

It's pretty difficult to excuse these levels of insider looting, but the experts are doing their best to claim that these poor executives (the titans of their industries) must take profits from stock sales because their salaries and bonuses have been cut. Who do they think they are kidding? Wall Street is still paying record salaries and bonuses, reportedly worth $144 billion (about a $1000 for every working American). There also has been very little news of other industry executives taking pay cuts, as American companies are holding record levels of cash to the tune of over a trillion dollars.

In fact, the flush-with-cash CEOs continue to blame the consumer class for joblessness. Despite the mass exodus of executives from their own company's stock, the S&P continues to remain somewhat stable since gaining 16% from July lows.

In fact, the flush-with-cash CEOs continue to blame the consumer class for joblessness. Despite the mass exodus of executives from their own company's stock, the S&P continues to remain somewhat stable since gaining 16% from July lows.

| The Real Market |

Major food commodities are up over 50% since their July lows, while oil prices have climbed $10 to over $81/bbl, or around 14% for the same time period, with predictions to break the $100/bbl mark very shortly.

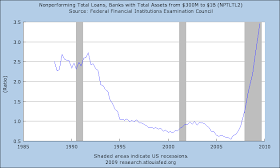

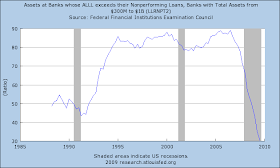

Barely covering the cost of real inflationary measures is hardly success, especially with the current risks involved with being in the stock market. These risks have only increased since the 2008 financial collapse that eventually caused the stock market to bottom out the mid-6000 range.

More frightening (sorry no treats just trick$ ;-)

- (CBS) The economic jam we're in has topped even the Great Depression.

- Unemployment has been at nine and a half percent or above for 14 months.

- Unemployment benefits to run out after 99 weeks that cost a massive debt over $100 billion to already broken tax payers

- FORECLOSURE FRAUD & $45 TRILLION DOLLARS