Oil and food supplies are normal or high - So what is really raising prices?

Nothing. Your dollar is just worth less when you dilute its value by trillions (see Why does Bernanke hate me?)

Your dollar is just worth less when you dilute its value by trillions (see Why does Bernanke hate me?)

Dollar is tanking faster than ever at 72.904 as a new local low.

It is getting down into into the critical support zone established in 2008.

The great unknown, as you know, is below 70.792.

Gallup Poll Shows that More Americans Believe the U.S. is in a Depression than is Growing ... Are They Right?

The April 20-23 Gallup survey of 1,013 U.S. adults found that only 27 percent said the economy is growing. Twenty-nine percent said the economy is in a depression and 26 percent said it is in a recession, with another 16 percent saying it is "slowing down," Gallup said.

Wal-Mart’s core shoppers are running out of money much faster than a year ago...

due to rising gasoline prices, and the retail giant is worried, CEO Mike Duke said Wednesday (CNN)

“We’re seeing core consumers under a lot of pressure,” Duke said at an event in New York. “There’s no doubt that rising fuel prices are having an impact.”

Wal-Mart shoppers, many of whom live paycheck to paycheck, typically shop in bulk at the beginning of the month when their paychecks come in.

Lately, they’re “running out of money” at a faster clip, he said.

“Purchases are really dropping off by the end of the month even more than last year,”

Duke said. “This end-of-month [purchases] cycle is growing to be a concern. NOTE: In the first-ever press conference by the U.S. Federal Reserve, Fed Chairman Ben Bernanke stressed to reporters that "longer-term inflation expectations have remained stable and measures of underlying inflation are still subdued," and Fed policies would keep "transitory inflation" under control.

Bernanke acknowledged that escalating prices of oil, energy and other commodities have recently pushed up inflation, but reiterated that those increases aren't expected to translate into "core" inflation over the long haul????

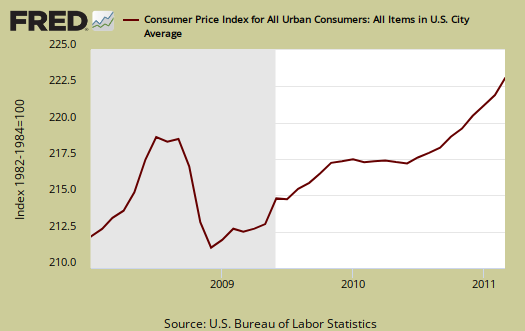

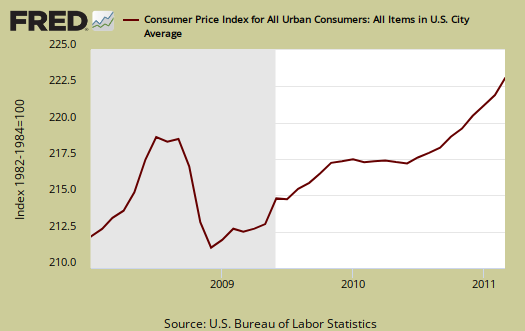

Haase - The Fed uses the consumer price index (CPI) excluding food and fuel prices, known as "core" inflation, as a benchmark barometer of inflation.

Core inflation was up 1.2% in March from a year before, but with food and fuel prices, the CPI in March rose 2.7% from a year ago. The Fed also looks at the core Personal Consumption Expenditure (PCE) deflator, which measures the average increase in prices for domestic personal consumption excluding food and energy prices. The core PCE deflator was up 0.9% in February from a year before, and the overall PCE deflator was up 1.6%. Numbers for March will be released today. In economic projections released at the conference, the Fed raised its 2011 inflation outlook to 2.1% to 2.8% from its January prediction of 1.3% to 1.7%. "What one should be seeing at this point is not just low core inflation but declining inflation - deflation - and yet what we're seeing is actually a gradual rise, and inflation expectations have been rising for the past six months," economist Edward Hadas told The Financial Times.

Oh and why do we ignore this?

"If a picture is worth one thousand words, then The Oil Age Poster is worth one million words because people can not only see the oil production Hubbert's peaks in many countries and regions, but also read the facts proving that global peak oil is both inevitable and quite probably imminent."

"If a picture is worth one thousand words, then The Oil Age Poster is worth one million words because people can not only see the oil production Hubbert's peaks in many countries and regions, but also read the facts proving that global peak oil is both inevitable and quite probably imminent."

- U.S. Congressman R. Bartlett

- U.S. Congressman R. Bartlett

Nothing.

Your dollar is just worth less when you dilute its value by trillions (see Why does Bernanke hate me?)

Your dollar is just worth less when you dilute its value by trillions (see Why does Bernanke hate me?)Dollar is tanking faster than ever at 72.904 as a new local low.

It is getting down into into the critical support zone established in 2008.

The great unknown, as you know, is below 70.792.

Instead of directly helping the American people, the government threw trillions at the giant banks (including foreign banks; and see this) . The big banks have - in turn - used a lot of that money to speculate in commodities, including food and other items which are now driving up the price of consumer necessities [as well as stocks]. Instead of using the money to hire Americans, they're hiring abroad (and getting tax refunds from the government).

Gallup Poll Shows that More Americans Believe the U.S. is in a Depression than is Growing ... Are They Right?

The April 20-23 Gallup survey of 1,013 U.S. adults found that only 27 percent said the economy is growing. Twenty-nine percent said the economy is in a depression and 26 percent said it is in a recession, with another 16 percent saying it is "slowing down," Gallup said.

Wal-Mart’s core shoppers are running out of money much faster than a year ago...

due to rising gasoline prices, and the retail giant is worried, CEO Mike Duke said Wednesday (CNN)

“We’re seeing core consumers under a lot of pressure,” Duke said at an event in New York. “There’s no doubt that rising fuel prices are having an impact.”

Wal-Mart shoppers, many of whom live paycheck to paycheck, typically shop in bulk at the beginning of the month when their paychecks come in.

Lately, they’re “running out of money” at a faster clip, he said.

“Purchases are really dropping off by the end of the month even more than last year,”

Duke said. “This end-of-month [purchases] cycle is growing to be a concern. NOTE: In the first-ever press conference by the U.S. Federal Reserve, Fed Chairman Ben Bernanke stressed to reporters that "longer-term inflation expectations have remained stable and measures of underlying inflation are still subdued," and Fed policies would keep "transitory inflation" under control.

Bernanke acknowledged that escalating prices of oil, energy and other commodities have recently pushed up inflation, but reiterated that those increases aren't expected to translate into "core" inflation over the long haul????

Haase - The Fed uses the consumer price index (CPI) excluding food and fuel prices, known as "core" inflation, as a benchmark barometer of inflation.

Core inflation was up 1.2% in March from a year before, but with food and fuel prices, the CPI in March rose 2.7% from a year ago. The Fed also looks at the core Personal Consumption Expenditure (PCE) deflator, which measures the average increase in prices for domestic personal consumption excluding food and energy prices. The core PCE deflator was up 0.9% in February from a year before, and the overall PCE deflator was up 1.6%. Numbers for March will be released today. In economic projections released at the conference, the Fed raised its 2011 inflation outlook to 2.1% to 2.8% from its January prediction of 1.3% to 1.7%. "What one should be seeing at this point is not just low core inflation but declining inflation - deflation - and yet what we're seeing is actually a gradual rise, and inflation expectations have been rising for the past six months," economist Edward Hadas told The Financial Times.

Oh and why do we ignore this?