O.K. I will not pretend to even understand what Bernanke is thinking, as it goes against everything learned in recent and longterm studies on sustainable economies.

But, I thought I was doing the right thing in 2008 by moving my 401K from market volatility and investing in the solvency of America by moving to government bonds?

Bernanke then sold my investment to by $600 Billion more debt... I gave him the money to pay off his debt -WTF

He is now planning on asking me for more as Fed Prints Another $600 Billion to Keep US Recovery on Track???

I have worked and paid taxes since the age of 14, and have a hard time understanding how my family and I could ever pay off our "contributions" to our household debt toll of more than $170,000 as we enter the next decade of hardship?

Bernanke then sold my investment to by $600 Billion more debt... I gave him the money to pay off his debt -WTF

He is now planning on asking me for more as Fed Prints Another $600 Billion to Keep US Recovery on Track???

I have worked and paid taxes since the age of 14, and have a hard time understanding how my family and I could ever pay off our "contributions" to our household debt toll of more than $170,000 as we enter the next decade of hardship?

I was brought up to understand that the best investment I could make was in the future of America. With China officially the United States' biggest foreign creditor, with roughly $900 billion in Treasury holdings -- or over $1 trillion with Hong Kong's holdings included. (Reuters)

Most experts say if there were signs of this happening, the U.S. government would go for a combination of persuading Americans to buy more U.S. debt, the same way they did in World War II, and finding friendly foreign governments to make additional purchases.

"The U.S. government should have and maybe still could call on the people of the U.S. to invest in U.S. debt," said David Walker, a former U.S. comptroller general who heads an advocacy group calling on the government to curb the U.S. budget deficit and borrowings.

To be sure, the idea that China would suddenly sell its U.S. debt holdings is almost unimaginable to some.

Is Bernanke punishing everyone who wants to invest in Americas?

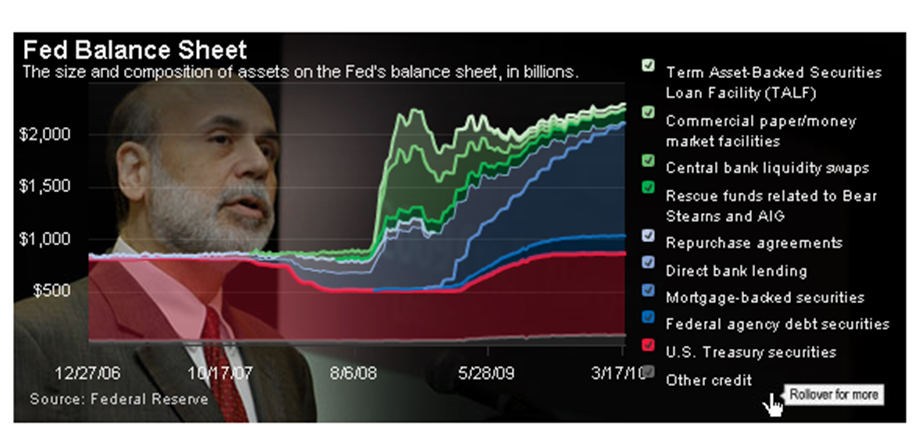

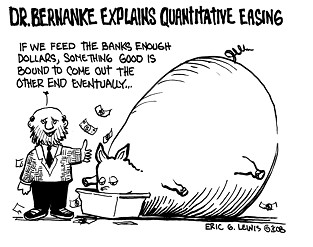

Is Bernanke punishing everyone who wants to invest in Americas?Telegraph: The latest round of quantitative easing (QE) comes on top of the $1.7 trillion already completed and is intended "to promote a stronger pace of recovery", the Fed said. It is changing tack, however, buying US government bonds instead of corporate debt and mortgage-backed securities. Existing QE will be rolled over, but also recycled into treasuries.

By the end of June, the Fed expects to have bought $850bn to $900bn of treasuries – roughly $110bn a month, $75bn of which will be additional QE.

By the end of June, the Fed expects to have bought $850bn to $900bn of treasuries – roughly $110bn a month, $75bn of which will be additional QE. - Yields on 10-year US government bonds dipped

- The dollar fell against most currencies due to QE,

- The Fed's decision will also heap pressure on the Bank of England to follow suit

- Nearly everyone who understands economics ;-)

- Feds Buying $600 Billion More Debt Impossible To Pay Off

- It Is Now Mathematically Impossible To Pay Off The U.S. National Debt

- Quantitative Easing Is Causing Food Prices to Skyrocket

As previously noted, interest rates have risen both times after the Fed implemented quantitative easing.

Graham Summers points out that food prices have also skyrocketed both times:

In case you’ve missed it, food riots are spreading throughout the developing world Already Tunisia, Algeria, Oman, and even Laos are experiencing riots and protests due to soaring food prices.As Abdolreza Abbassian, chief economist at the UN’s Food and Agriculture Organization (FAO), put it, “We are entering a danger territory.”Indeed, these situations left people literally starving… AND dead from the riots.And why is this happening?A perfect storm of increased demand, bad harvests from key exporters (Argentina, Russia, Australia and Canada, but most of all, the Fed’s money pumping. If you don’t believe me, have a look at the below chart:[Summers shows the share price of Elements Rogers International Commodity Agriculture ETN as a proxy for food prices generally.]As you can see, it wasn’t until the Fed announced its QE lite program that agricultural commodities exploded above long-term resistance. And in case there was any doubt, QE 2 sent them absolutely stratospheric.

This isn't really unexpected.

Last November, David Einhorn warned:HTML clipboard

Last November, David Einhorn warned:

Also in November, Karl Denninger wrote:It is quite likely that QE2 will slow the economy by raising food and energy prices [because it is easier to generate these price increases]. [These price hikes] would act as a tax on consumers and businesses.

We have a Federal Reserve that, in the last two years, has printed and debased the currency of this nation by more than 100%, taking their balance sheet from $800 billion to more than $2 trillion. They now threaten, today, to do even more of that. This has resulted in insane price ramps in soft commodities ....("soft commodities" means food crops).

As the Wall Street Journal, Tyler Durden, the Economic Policy Journal and others note, inflation in food prices isn't limited to developing nations, but is coming to the U.S