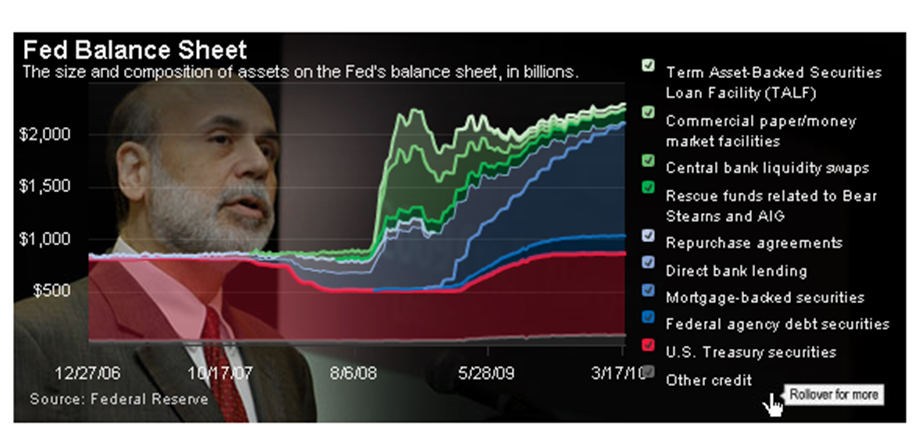

CNBC The New York Fed expects to conduct $850 billion to $900 billion in Treasury purchases through the end of the second quarter of 2011 and is expected to Pump Up to $1 Trillion Into US Economy. (guardian)

Indeed, some worry further bond buying could do more harm than good by providing tinder for inflation that will ignite when the recovery finally gains traction.

The Fed move is likely to weaken the dollar further... that will increase the cost of everything to Americans. Read more at CNBC

A lot of people are very upset about the rapidly increasing U.S. national debt these days and they are demanding a solution. What they don't realize is that there simply is not a solution under the current U.S. financial system.

It is now mathematically impossible for the U.S. government to pay off the U.S. national debt.

You see, the truth is that the U.S. government now owes more dollars than actually exist. If the U.S. government went out today and took every single penny from every single American bank, business and taxpayer, they still would not be able to pay off the national debt. And if they did that, obviously American society would stop functioning because nobody would have any money to buy or sell anything.

You see, the truth is that the U.S. government now owes more dollars than actually exist. If the U.S. government went out today and took every single penny from every single American bank, business and taxpayer, they still would not be able to pay off the national debt. And if they did that, obviously American society would stop functioning because nobody would have any money to buy or sell anything.And the U.S. government would still be massively in debt.

So why doesn't the U.S. government just fire up the printing presses and print a bunch of money to pay off the debt?

Well, for one very simple reason.

That is not the way our system works.

You see, for more dollars to enter the system, the U.S. government has to go into more debt.

The U.S. government does not issue U.S. currency - the Federal Reserve does.

The Federal Reserve is a private bank owned and operated for profit by a very powerful group of elite international bankers.

If you will pull a dollar bill out and take a look at it, you will notice that it says "Federal Reserve Note" at the top. It belongs to the Federal Reserve.

The U.S. government cannot simply go out and create new money whenever it wants under our current system.

Instead, it must get it from the Federal Reserve.

So, when the U.S. government needs to borrow more money (which happens a lot these days) it goes over to the Federal Reserve and asks them for some more green pieces of paper called Federal Reserve Notes.

The Federal Reserve swaps these green pieces of paper for pink pieces of paper called U.S. Treasury bonds. The Federal Reserve either sells these U.S. Treasury bonds or they keep the bonds for themselves (which happens a lot these days).

So that is how the U.S. government gets more green pieces of paper called "U.S. dollars" to put into circulation. But by doing so, they get themselves into even more debt which they will owe even more interest on.

So every time the U.S. government does this, the national debt gets even bigger and the interest on that debt gets even bigger. Read more here

Related?

The Federal Reserve Is Holding Conference To Celebrate 100 Years Of Dominating AmericaThe title of this conference is "A Return to Jekyll Island: The Origins, History, and Future of the Federal Reserve", and it will be held on November 5th and 6th in the exact same building where the original 1910 meeting occurred... 100 years later, Federal Reserve bureaucrats will return to Jekyll Island once again to "celebrate" the history and the future of the Federal Reserve.

Sadly, most Americans have no idea how the Federal Reserve came into being. Forbes magazine founder Bertie Charles Forbes was perhaps the first writer to describe the secretive nature of the original gathering on Jekyll Island in a national publication....Read here

It was a system that was designed by the bankers and for the bankers. Now, the bureaucrats running the system are returning to Jekyll Island to congratulate themselves.

Those attending the conference on November 5th and 6th include Federal Reserve Chairman Ben Bernanke, former Fed Chairman Alan Greenspan, Goldman Sachs managing director E. Gerald Corrigan and the heads of the various regional Federal Reserve banks.

You can view the entire agenda of the conference right here. It looks like that there will be plenty of hors d'oeuvres to go around, but should the Federal Reserve really be celebrating their accomplishments at a time when the U.S. economy is literally falling to pieces?

Today, 63 percent of Americans do not think that they will be able to maintain their current standard of living. 1.47 million Americans have been unemployed for more than 99 weeks. We are facing a complete and total economic disaster.