No one wants to call it the Great Depression so I coined it "Peak prosperity" Yep I stated it here first. For two decades we were warned of problems with peak oil, social security, middle east oil wars, energy crisis and our jobs moving overseas.

As the world sinks deeper into what he calls the Greater Depression, Casey Research Chairman Doug Casey sees default on the U.S. national debt as inevitable—albeit probably in the guise of currency destruction. He anticipates further contraction in real estate, particularly on the commercial front. As long as stocks remain overpriced, he'll shy away from equities—except perhaps in favored sectors, such as gold. In fact, in this exclusive interview with The Gold Report, Doug posits that gold juniors might "go up by an order of magnitude or more, even while most other stocks are going down."2011: The Year Cities Go Bust?HTML clipboard and The DOW Still Hasn't Made It Past Y2K I recognize that an outright default is most unlikely, but...debt will be defaulted on one way or another. The trouble is they're almost certainly going to default on it through inflation, by destroying the currency, which is much worse than defaulting on it overtly. That's because inflation will wipe out the relatively few people who are prudent in this country, those who are actually saving money. Because they generally save in the form of dollars, they're going to wipe them out financially. It's just horrible. Runaway inflation will reward the profligates who are in debt—people who've been living above their means. And punish the producers who've been saving and trying to build capital. That's in addition to the fact it will destroy millions of productive enterprises. A runaway inflation is the worst thing that can happen to a society, short of a major war. They just should default on it honestly, as it were. Continue reading "Doug Casey"

- With 157 banks collapsing this year, that means more banks failed in 2010 than any year since 1992, the Wall Street Journal reports.

- States and Cities In Worst Shape Since the Great Depression

- States and cities are in dire financial straits, and many may default in 2011.

- California is issuing IOUs for only the second time since the Great Depression.

- Things haven't been this bad for state and local governments since the 30s.

More than 100 American cities could go bust next year as the debt crisis that has taken down banks and countries threatens next to spark a municipal meltdown, a leading analyst has warned. Meredith Whitney, the US research analyst who correctly predicted the global credit crunch, described local and state debt as the biggest problem facing the US economy, and one that could derail its recovery. "Next to housing this is the single most important issue in the US and certainly the biggest threat to the US economy," Whitney told the CBS 60 Minutes programme on Sunday night. "There's not a doubt on my mind that you will see a spate of municipal bond defaults. You can see fifty to a hundred sizeable defaults – more. This will amount to hundreds of billions of dollars' worth of defaults." ( read 60 minute the transcript) US states have spent nearly half a trillion dollars more than they have collected in taxes, and face a $1tn hole in their pension funds ...

A new survey of unemployed American workers documents dramatic erosion in the quality of life for millions of Americans. Their financial reserves are exhausted, their job prospects nil, their family relations stressed and their belief in government's ability to help them is negligible. They feel hopeless and powerless, unable to see their way out of the Great Recession that has claimed 8.5 million jobs.

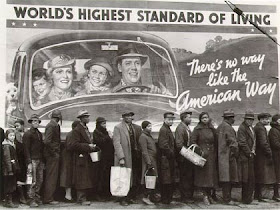

Specifically, economics professors Saez (UC Berkeley) and Piketty (Paris School of Economics) show that the percentage of wealth held by the richest 1% of Americans peaked in 1928 and 2007 - right before each crash:As the Washington Post's Ezra Klein wrote in June:

Krugman says that he used to dismiss talk that inequality contributed to crises, but then we reached Great Depression-era levels of inequality in 2007 and promptly had a crisis, so now he takes it a bit more seriously...

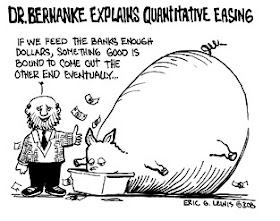

Given the above facts, it would seem that the government hasn't been doing much. But the scary thing is that the government has done more than during the Great Depression, but the economy is still stuck a pit. Specifically, many economists credit World War II with getting us out of the Depression. (I disagree, but that's another story). This time, we've been at war in both Iraq and Afghanistan far longer than we were in World War II. But our economy is still stuck in a rut. Moreover, the amount spent in emergency bailouts, loans and subsidies during this financial crisis arguably dwarfs the amount which the government spent during the New Deal. For example, Casey Research wrote in 2008:

Paulson and Bernanke have embarked on the largest bailout program ever conceived .... a program which so far will cost taxpayers $8.5 trillion.

The chart above shows that the entire cost of WWII over four to five years was less than half the current pledges made by Paulson and Bernanke in the last three months! In spite of years of conflict, the Vietnam and the Iraq wars have each cost less than the bailout package that was approved by Congress in two weeks. The Civil War that devastated our country had a total price tag (for both the Union and Confederacy) of $60.4 billion, while the Revolutionary War was fought for a mere $1.8 billion. In its fifty or so years of existence, NASA has only managed to spend $885 billion – a figure which got us to the moon and beyond. The New Deal had a price tag of only $500 billion. The Marshall Plan that enabled the reconstruction of Europe following WWII for $13 billion, comes out to approximately $125 billion in 2008 dollars. The cost of fixing the S&L crisis was $235 billion.