Peak Prosperity

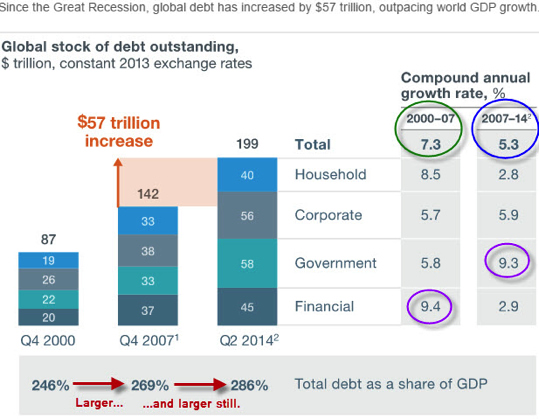

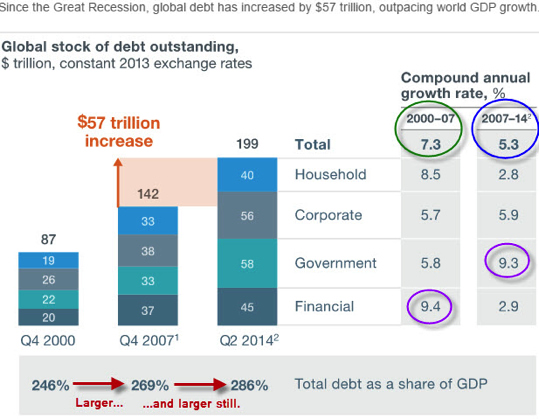

...Our diagnosis of the fatal flaw facing the global economy and its financial systems has remained unchanged since before 2008. We can sum it up with these three simple words: Too much debt.The chart below visualizes our predicament plainly. It has always been mathematically impossible (not to mention intellectually bankrupt) to expect to grow one's debt at twice the rate of one's income in perpetuity:

All but the most blinkered can rapidly work out the fallacy captured in the above chart. Sooner or later, borrowing at a faster rate than income growth was going to end because it has to. Again, it's just math. Math that our central planners seem blind to, by the way -- all of whom embrace "More debt!" as a solution, not a problem.

Despite being given the opportunity to re-think their strategy in the wake of the 2008 credit crisis, the world's central banks instead did everything in their considerable power to create conditions for the most rapid period of credit accumulation in all of history:

Lesson not learned!

The chart's global debt number is only larger now, somewhere well north of $200 trillion here in Q1 2016. But consider, if you will, that entire world had 'only' managed to accumulate $87 trillion in total debt by 2000 (this is just debt, mind you, it does not include the larger amount of unfunded liabilities). Yet governments then managed to pour on an additional $57 trillion just between the end of 2007 and the half way point of 2014, just seven and half short years later.

Was this a good idea? Or monumental stupidity? We're about to find out.

My vote is on stupidity.

Banks In Trouble

In just the first few weeks of 2016, the prices of many bank stocks have suddenly dropped to deeply distressed territory. And the price of insurance against default on the bonds of those banks is now spiking.

While we don't know exactly what ails these banks -- and, if history is any guide, we probably won't find out until after this next crisis is well underway -- but we can tell from the outside looking in that something is very wrong.

In today's hyper-interconnected world of global banking, if one domino falls, it will topple any number of others. The points of connectivity are so numerous and tangled that literally no human is able to predict with certainty what will happen. Which is why the action now occurring in the banking sector is beginning to smell like 2008 all over again:

Gundlach Says 'Frightening' Seeing Financial Stocks Below Crisis

Feb 5, 2016

DoubleLine Capital's Jeffrey Gundlach said it's "frightening" to see major financial stockstrading at prices below their financial crisis levels.

He cited Deutsche Bank AG and Credit Suisse Group AG as examples in a talk outlining bearish views at a conference in Beverly Hills, California, on Friday. Both banks fell this week to their lowest levels since the early 1990s in European trading.

"We see the price of major financial stocks, particularly in Europe, which are truly frightening," Gundlach said. "Do you know that Credit Suisse, which is a powerhouse bank, their stock price is lower than it was in the depths of the financial crisis in 2009? Do you know that Deutsche Bank is at a lower price today than it was in 2009 when we were talking about the potential implosion of the entire global banking system?"

(Source)

This time it looks like the trouble is likely to begin in Europe, where we've been tracking the woes of Deutsche Bank (DB) for a while. But in Italy, banks are carrying 18% non-performing loans and an additional double digit percentage of 'marginally performing' or impaired loans. Taken together, these loans represent more than 20% of Italy's GDP, which is hugely problematic.

The Italian banking sector may have upwards of 25% to 30% bad or impaired loans on the books. That means the entire banking sector is kaput. Finis. Insolvent and ready for the restructuring vultures to take over.

On average, in a fractional reserve banking system operating at a 10% reserve ratio, when a bank's bad loans approach its reserve ratio, it's pretty much toast. By 15% that's pretty much a certainty. By 20% you just need to figure out which resolution specialist to call. At 25% or 30%, you probably should pack a bag and skip town in the dead of night.

This handy chart provides some of the context for Europe more broadly. I've highlighted everything from Europe in yellow, showing how the banks there currently top the list of awfulness:

(Source)

The extreme weakness in European financial shares, combined with other factors, is dragging down Europe's stock market dramatically. The decline has now wiped out all of 2015's market gains and has broken convincingly below the neckline (yellow line, below) of a typical "Head & Shoulders" formation:

Since the beginning of the year, the stock prices of these select banks are down (as of COB Friday 2/5/16):

- DB -28.3%

- Credit Swiss -29.9%

- MS -22.6%

- C -22.0%

- Barclays -21.7%

- BAC -21.2%

- UBS -20.3%

- RBS -19.6%

Those are pretty hefty losses over a short period of time, and that's meaningful. While the headline equity indexes are managing to keep their losses minimized, these bellwether stocks from the critical finance sector are stampeding out the back door.

And when I say 'critical', I mean in the sense that a hefty amount of the overall earnings within the S&P 500 and other major stock indexes were fraudulent profits were derived from the banks feeding on central bank thin-air money and front-running central bank policy.

What's there to worry about? Well, just pick something. It could be a combination of headwinds conspiring to drag down bank earnings from here. Take your pick: reduced trading and M&A revenue, and lower profits from ridiculously flat yield curves and negative interest rates.

However, we have to include the possibility that No more bailouts are coming. Why not? Mainly because it would be politically incendiary at this moment to even try such a thing. Public resentment of the banks is high all over the world, and in the US specifically, there's an election primary that is hinging for the Democrats on Wall Street coziness. Maybe the markets are pricing that in?

Please continue reading from:

http://www.peakprosperity.com/blog/96701/return-crisis