From theOILdrum - Futures Position Limits on Energy?

Unfortunately, this 'speculation' issue is one of many red herrings that ignores the widening fundamental disconnect between financial and real assets.

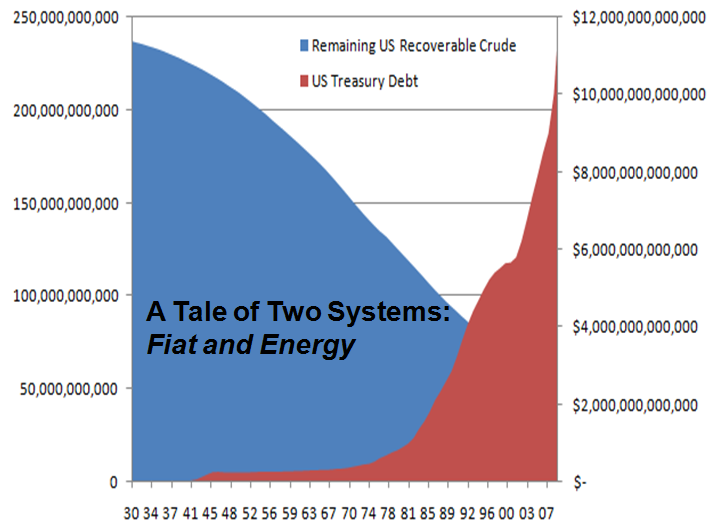

Energy and natural resources are what we have to spend (or to marshal). Money is just a marker for these real assets, and the ever expanding definition of money - now extending to margin, credit, debt, on and off balance sheet derivatives, etc. - has caused an extreme, paradigm changing disconnect between financial assets, and what they were originally designed to represent. We need growth in order to pay back debt and need energy gain ((gross - costs)*scale) in order to grow.

Based on historic comparisons - commodities were the ugly stepchild in investment portfolios. As long as energy and resources were cheap, more long term gearing/profits were to be had from the vanilla 'derivatives': stocks and bonds, than from the commodities themselves. But as the world was flooded not only with liquidity in recent decades, but an order of magnitude (or more) increase in notional credit, relaxed oversight rules, relaxed lending standards, higher leverage, etc., these digits have had to find a home. Their doing so culminated in 2007-8 via a dramatic commodity market rall. What really happened in the ensuing 9 months was not a sharp drop in commodity demand, but a global margin call of epic proportions.

The point of this is that oil was not in a speculative bubble, unless you amend that statement to: "oil was one of many instruments in a fiat liquidity bubble, but it was the most important commodity to the global economy so the media paid most attention to it".

As we are mired in a deepening recession,

... The blame it seems, will again fall on speculators. As we have been writing on these pages for years, oil supply has maxed out, so any stabilization in demand will naturally result in rising prices... In the end the demand for paper natural gas is higher than the demand for real natural gas.

So what does this mean?

Energy, particularly liquid fuel, is the hemoglobin of modern civilization. Price signals based on the marginal unit create long term distortions for utilities and energy policymakers. On the micro level, it is only a matter of time before a highly leveraged, underregulated hedge fund (think Amaranth, Ospraie, but bigger) causes dislocation in energy markets due to their size. On the macro level, depending on which estimates you trust, global notional derivatives are in excess of 1,000 trillion, while global GDP is only $55 trillion (and a decent chunk of that financial, aka questionable). If we accept the peak oil estimates of global remaining recoverable crude oil of around 1 trillion barrels, that equates to $62 trillion using todays closing NYMEX price. This is roughly equal to US treasury total debt (including unfunded Medicare, Social Security liabilities)

We have a monumental problem - a system whose claims on the future are higher than its real assets... We will continue to borrow from all aspects of our socio-ecological system to keep the current paradigm intact (growth at all costs, marginal unit pricing, infinite substitutes, market will solve it, etc). Sooner, rather than later, a plan for re-linking scarce resources to what and how we execute social transactions is going to occur.

I am in favor of an energy based currency and no futures trading at all other than for producers and those taking delivery. But these ideas are so many steps beyond 'regulating oil futures in order to keep prices low' I expect I am wasting my breath.

Read full and join discussion at theOILdrum