Updated from March Post:

I still dream in color, yet our nations 'economic load' and lack of growth to ever catch up has my children's dreams solidified in gray ... our gray debt cloud is making a previously unsustainable problem, epic."Men fight for liberty and win it with hard knocks. Their children, brought up easy, let it slip away again, poor fools. And their grandchildren are once more slaves." - D.H. Lawrence

Haase - Short Answer:

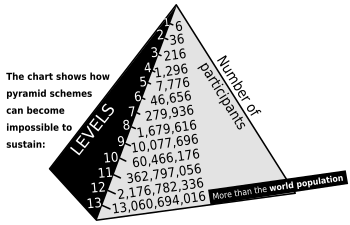

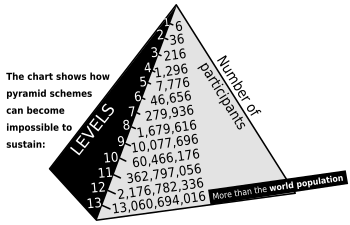

We built a national pyramid scheme that encouraged everyone at the top (top earns) to spend and build far beyond sustainable limits of the middle tier (middle class). When the people at the bottom tier (creditors) of the scheme wanted to collect... the jig was up.

And Bernard Madoff was set as world example.

Then we dumped a truck full of 'monopoly money' on the problem to 'fix it'...this was like giving a college student a new credit card after they maxed out the first one on 'beer and pizza'

HTML clipboard

WIKI summary- At the end of fiscal year 2009, the gross debt was 83.4% of GDP that equates to over $30400 per person U.S. population, with less than half the population working... in other words - The working class is currently in personal debt and carrying a GOV debt load of over 60,800 per worker...

We built a national pyramid scheme that encouraged everyone at the top (top earns) to spend and build far beyond sustainable limits of the middle tier (middle class). When the people at the bottom tier (creditors) of the scheme wanted to collect... the jig was up.

And Bernard Madoff was set as world example.

Then we dumped a truck full of 'monopoly money' on the problem to 'fix it'...this was like giving a college student a new credit card after they maxed out the first one on 'beer and pizza'

WIKI summary- At the end of fiscal year 2009, the gross debt was 83.4% of GDP that equates to over $30400 per person U.S. population, with less than half the population working... in other words - The working class is currently in personal debt and carrying a GOV debt load of over 60,800 per worker...

Sorry, these are "Just the facts, ma'am" (Source CIA) HTML clipboard

How we got here and were we are going:

CIA..."Soaring oil prices between 2005 and the first half of 2008 threatened inflation and unemployment, as higher gasoline prices ate into consumers' budgets. Imported oil accounts for about two-thirds of US consumption. Long-term problems include inadequate investment in economic infrastructure, rapidly rising medical and pension costs of an aging population, sizable trade and budget deficits, and stagnation of family income in the lower economic groups. The merchandise trade deficit reached a record $840 billion in 2008 before shrinking to $450 billion in 2009. The global economic downturn, the sub-prime mortgage crisis, investment bank failures, falling home prices, and tight credit pushed the United States into a recession by mid-2008. GDP contracted till the third quarter of 2009, making this the deepest and longest downturn since the Great Depression. "

"The Pew Trust has done the math and it turns out the the economic crash of 2008 incurred about $108,000 per US household in costs and stock and house-price losses:

The Impact of the September 2008 Economic Collapse (via The Consumerist)U.S. households lost on average nearly $5,800 in income due to reduced economic growth during the acute stage of the financial crisis from September 2008 through the end of 2009.[1] Costs to the federal government due to its interventions to mitigate the financial crisis amounted to $2,050, on average, for each U.S. household. Also, the combined peak loss from declining stock and home values totaled nearly $100,000, on average per U.S. household, during the July 2008 to March 2009 period. This analysis highlights the importance of reducing the onset and severity of future financial crises, and the value of market reforms to achieve this goal."

Cash, Carry and Energy Break down:

GDP - per capita (PPP):

GDP - real growth rate:

-2.4% (2009 est.)

-2.4% (2009 est.)

Population: (VIA census)

308,954,672

Labor force:

154.5 million (includes unemployed) (2009)

140.5 Minus unemployed

Budget:

revenues: $1.914 trillion

expenditures: $3.615 trillion (2009 est.)

Public debt: 52.9% of GDP (2009 est.)

U.S. is #1 in the following sectors:

Electricity - consumption: 3.873 trillion kWh (2008 est.)

Oil - consumption: 19.5 million bbl/day (2008 est.)

Oil - consumption: 19.5 million bbl/day (2008 est.)

Natural gas - consumption: 657.2 billion cu m (2008 est.)

Natural gas - imports: 112.7 billion cu m (2008 est.)

Debt - external: $13.45 trillion (30 June 2009)

Debt - external: $13.45 trillion (30 June 2009)

All of this is not very encouraging considering the 'majority' of politicians believe the economy could collapse again... Knowing that we have built current debt pay off models under the false pretense that 'not only will the GDP grow, but the economy will rebound and return to past growth levels'.

--------------------------------------------------------------------

Update: Insolvent?

"...In FY2009, the U.S. government collected $2.1 trillion in revenue (15% of GDP) and spent almost $3.5 trillion (25% of GDP). Between FY2008 and FY2009, outlays increased by $535 billion, while revenues fell by $419 billion. The deficit in FY2009 was $1,414 billion, or 9.9% of GDP, sharply higher than deficits in recent years." - Open CRS

--------------------------------------------------------------------

CBO report: Debt will rise to 90% of GDP

--------------------------------------------------------------------

Wall Street Journal,: "President Barack Obama asserted that the government "simply cannot continue to spend as if deficits don't have consequences; as if waste doesn't matter; as if the hard-earned tax dollars of the American people can be treated like Monopoly money; as if we can ignore this challenge for another generation."

The proposed budget:

- The budget would permanently expand the federal government by 3 percent of gross domestic product over 2007 prerecession levels.

- Taxes would be raised on all Americans by nearly $3 trillion over the next decade.

- It would raise taxes for 3.2 million small businesses and upper-income taxpayers by an average of $300,000 over the next decade.

- For every dollar spent in 2010, 42 cents would be borrowed.

- Would run a $1.6 trillion deficit in 2010 -- $143 billion higher than the recession-driven 2009 deficit.

- Would leave permanent deficits that top $1 trillion as late as 2020.

- Would dump an additional $74,000 per household of debt into the laps of our children and grandchildren.

- Would double the publicly held national debt to over $18 trillion.

Haase - But, "Don't cry for me Argentina"

-----------------------------------------------------------------------------------------

Related?

We're Number 61!

One item that doesn't fall into the it-could-be-worse department—see above—is the U.S. corporate income tax. It's already about as bad as can be. This year, American businesses may spend 89 cents preparing their taxes for every dollar they pay in taxes.

In a new estimate, David Keating of the National Taxpayers Union estimates that the cost of compliance with the corporate tax is $159.4 billion—or 89% of expected tax collections for fiscal 2009, and 54% for 2008. That includes the ...

The Huge, Hidden Tax You Pay for Government

Taxpayers rushing to fill out and file their form 1040 today may think their obligation to the federal government is complete. But it's really just beginning. Although Americans paid more than $900 billion in income taxes last year, there's a far larger tax bill hidden from view. That tax is regulation.

NY Post - How 'soaking the rich' clobbers you

Nearly half of American tax filers didn't have to pay any federal income tax last year...Just a decade ago, two-thirds of American tax filers still paid into the tax system. But both Democrats and Republicans have spent the last quarter-century inventing and expanding all kinds of voter-friendly tax breaks. Easy-to-use tax software has helped people get every dollar -- something that was once less common, because it simply wasn't worth the bother. …..But everyone should have to pay something -- and anyone who earns enough to have cable TV can pay something toward their own national defense, too. A big majority of people, in fact, should pay enough to be annoyed on April 15 rather than excited. Otherwise, the politicians will figure they can just keep spending without angering a critical mass of voters.

Nearly half of American tax filers didn't have to pay any federal income tax last year...Just a decade ago, two-thirds of American tax filers still paid into the tax system. But both Democrats and Republicans have spent the last quarter-century inventing and expanding all kinds of voter-friendly tax breaks. Easy-to-use tax software has helped people get every dollar -- something that was once less common, because it simply wasn't worth the bother. …..But everyone should have to pay something -- and anyone who earns enough to have cable TV can pay something toward their own national defense, too. A big majority of people, in fact, should pay enough to be annoyed on April 15 rather than excited. Otherwise, the politicians will figure they can just keep spending without angering a critical mass of voters.

As it is, Washington just figures that when it comes time for tax hikes to pay for all the spending we're doing with borrowed money, the "rich" will pay.