Companies all over America have been dropping their pension plans in anticipation of the time when the Baby Boomers would retire. 401k programs were supposed to be part of the answer, but if the stock market crashes again, it is absolutely going to devastate the Baby Boomers.

Companies all over America have been dropping their pension plans in anticipation of the time when the Baby Boomers would retire. 401k programs were supposed to be part of the answer, but if the stock market crashes again, it is absolutely going to devastate the Baby Boomers.- Beginning January 1st, 2011 every single day more than 10,000 Baby Boomers will reach the age of 65. That is going to keep happening every single day for the next 19 years.

- According to one recent survey, 36 percent of Americans say that they don't contribute anything at all to retirement savings.

- Pension consultant Girard Miller recently told California's Little Hoover Commission that state and local government bodies in the state of California have $325 billion in combined unfunded pension liabilities. When you break that down, it comes to $22,000 for every single working adult in California.

- According to a recent report from Stanford University, California's three biggest pension funds are as much as $500 billion short of meeting future retiree benefit obligations.

- Robert Novy-Marx of the University of Chicago and Joshua D. Rauh of Northwestern's Kellogg School of Management recently calculated the combined pension liability for all 50 U.S. states. What they found was that the 50 states are collectively facing $5.17 trillion in pension obligations, but they only have $1.94 trillion set aside in state pension funds. That is a difference of 3.2 trillion dollars. So where in the world is all of that extra money going to come from? Most of the states are already completely broke and on the verge of bankruptcy.

- According to the Congressional Budget Office, the Social Security system will pay out more in benefits than it receives in payroll taxes in 2010. That was not supposed to happen until at least 2016. Sadly, in the years ahead these "Social Security deficits" are scheduled to become absolutely horrific as hordes of Baby Boomers start to retire.

- In 1950, each retiree's Social Security benefit was paid for by 16 U.S. workers. In 2010, each retiree's Social Security benefit is paid for by approximately 3.3 U.S. workers. By 2025, it is projected that there will be approximately two U.S. workers for each retiree. How in the world can the system possibly continue to function properly with numbers like that?

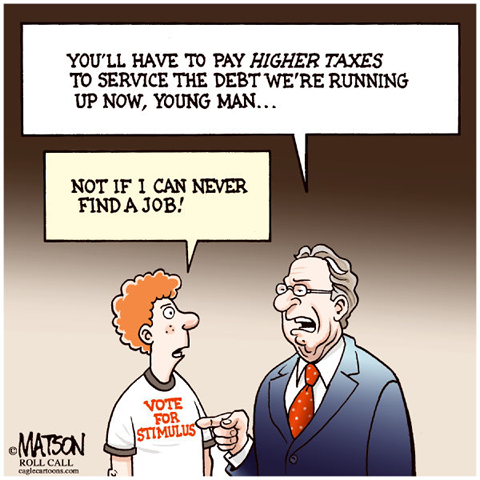

- According to a recent U.S. government report, soaring interest costs on the U.S. national debt plus rapidly escalating spending on entitlement programs such as Social Security and Medicare will absorb approximately 92 cents of every single dollar of federal revenue by the year 2019. That is before a single dollar is spent on anything else.

- After analyzing Congressional Budget Office data, Boston University economics professor Laurence J. Kotlikoff concluded that the U.S. government is facing a "fiscal gap" of $202 trillion dollars. A big chunk of that is made up of future obligations to Social Security and Medicare recipients.

State and local governments are scrambling to find ways to pay out all the benefits that they have been promising. Many state and local governments will be forced into some very hard choices by the hordes of Baby Boomers that will now be retiring.