Only the richest 5 percent of Americans are back in the stores because their stock portfolios have soared. The Dow Jones Industrial Average has doubled from its crisis low. Wall Street pay is up to record levels. Total compensation and benefits at the 25 major Wall St firms had been $130 billion in 2007, before the crash; now it's close to $140 billion.

Only the richest 5 percent of Americans are back in the stores because their stock portfolios have soared. The Dow Jones Industrial Average has doubled from its crisis low. Wall Street pay is up to record levels. Total compensation and benefits at the 25 major Wall St firms had been $130 billion in 2007, before the crash; now it's close to $140 billion.But a strong recovery can't be built on the purchases of the richest 5 percent. HTML clipboard

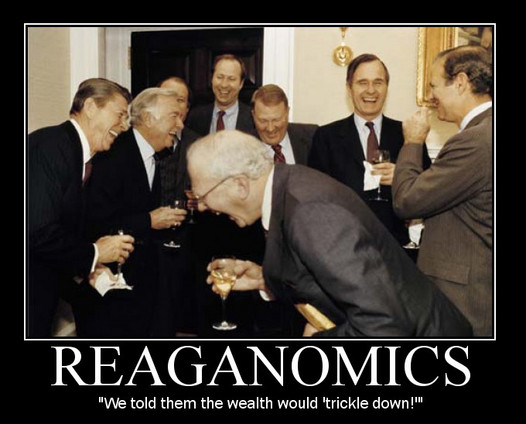

The truth is if the super-rich paid their fair share of taxes, government wouldn't be broke. If states hadn't handed out tax breaks to corporations and the well-off, and if Washington hadn't extended the Bush tax cuts for the rich, eviscerated the estate tax, and created loopholes for private-equity and hedge-fund managers, the federal budget wouldn't look nearly as bad.

And if America had higher marginal tax rates and more tax brackets at the top - for those raking in $1 million, $5 million, $15 million a year - the budget would look even better. We wouldn't be firing teachers or slashing Medicaid or hurting the most vulnerable members of our society. We wouldn't be in a tizzy over Social Security. We'd slow the rise in healthcare costs but we wouldn't cut Medicare. We'd cut defense spending and lop off subsidies to giant agribusinesses but we wouldn't view the government as our national nemesis.

The final truth is as income and wealth have risen to the top, so has political power. The reason all of this is proving so difficult to get across is the super-rich, such as the Koch brothers, have been using their billions to corrupt politics, hoodwink the public, and enlarge and entrench their outsized fortunes.

The final truth is as income and wealth have risen to the top, so has political power. The reason all of this is proving so difficult to get across is the super-rich, such as the Koch brothers, have been using their billions to corrupt politics, hoodwink the public, and enlarge and entrench their outsized fortunes. Read full from TPM

FACT - President Obama's Fiscal Year 2012 Budget Would Make Permanent 81 Percent of the Bush Tax Cuts

The budget outline released by President Obama this week, just like last year’s proposal, includes about $3.5 trillion in tax cuts over ten years. Most of that cost comes from his $3.1 trillion proposal to make permanent most of the Bush tax cuts, which would cost 81 percent as much as extending all the Bush tax cuts.

The budget outline released by President Obama this week, just like last year’s proposal, includes about $3.5 trillion in tax cuts over ten years. Most of that cost comes from his $3.1 trillion proposal to make permanent most of the Bush tax cuts, which would cost 81 percent as much as extending all the Bush tax cuts.

The President’s budget outline does include several laudable provisions to raise revenue, but not nearly enough to offset the costs of the proposed tax cuts. The net effect of the tax proposals in the budget plan would be to reduce federal revenue by $2.8 trillion over ten years, compared to what would happen if the Bush tax cuts simply expired (as they will under current law if Congress does nothing). Read More