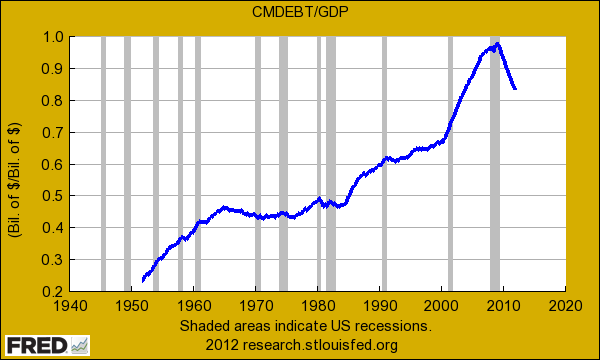

Total household debt to GDP continues to unwind signifying that US households did reach a peak debt situation in the current crisis. How is this being rectified?

-1. Foreclosures

-2. Bankruptcies

-3. Job losses

-4. Tighter credit markets

Yet overall access to debt to government and banks has remained open. Debt is part of our system but at a certain level it becomes unsustainable. We reached that point during the peak of the crisis. While households are going through this painful adjustment, some other segments of the economy seem to be delaying the inevitable. When we examine the crushing blow being felt by the middle class the above charts make more tangible sense. The cost of everything from education, housing, and automobiles seems high because purchasing power has fallen. A lower US dollar is only beneficial if the standard of living for many Americans increases. Look at the last few decades and try to see if that holds true.