ETF DAILY NEWS: And this particular tidbit of data is as important as it gets when we’re talking about economic health:

Via SGT Report and The Daily Crux with commentary by Pragmatic Capitalism:

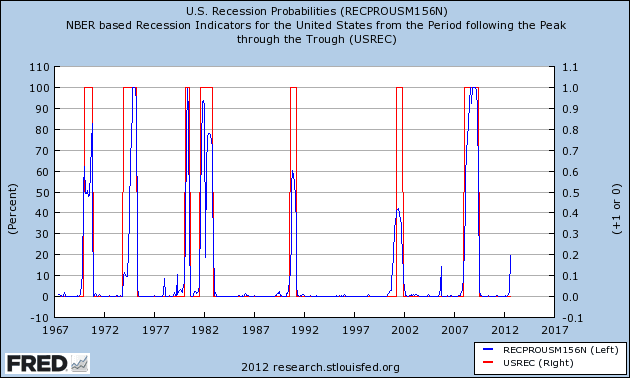

Here’s an interesting new data point that the St Louis Fed has put together to calculaterecession probabilities:

“Recession probabilities for the United States are obtained from a dynamic-factor markov-switching model applied to four monthly coincident variables: non-farm payroll employment, the index of industrial production, real personal income excluding transfer payments, and real manufacturing and trade sales. “

What’s interesting about this index is the current reading. At 20%, the index is at a level that has ALWAYS been followed by a recession. As you can see below, the index has never approached 20% without a subsequent recession. All 6 recessions since 1967 have coincided with 20%+ readings in the US Recession Probabilities index.

It’s no secret that the economy is still hurting. According to this report we are on the verge of another recession within the midst of a broader ‘depression.’ Contrarian analysts have already suggested this is the case, with many saying we’ve been in recession since at least summer.

Moreover, if you look at the real numbers behind the numbers, like the rate of real inflation, and bounce those against this purported economic growth you may be surprised to find that we never exited the recession!