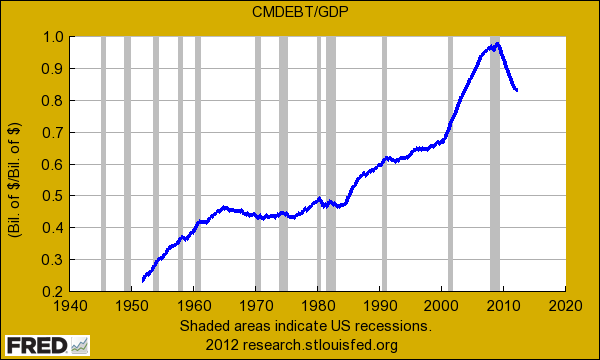

It is rather clear where the deleveraging started to happen. This is now a typical recession. This is shifting the landscape of how much debt households can really take on. Yet for government and banks, there doesn’t seem to be a limit although globally we are starting to see peak debt situations. Many countries are having issues even servicing their interest payments let alone thinking about paying back the debt they owe. These bailouts are simply methods of extending lines of credits to pay off already existing lines.

US households are clearly facing the grim reality that maybe they were not as wealthy as they once thought. After all, many do not even have enough for retirement and millions will completely rely on Social Security for years to come. This works well when you have a small older population with a large healthy working young population. Today we have a larger older population with a young less affluent population, with many not even working unfortunately.

So here we are hitting another debt ceiling limit right on time for the fiscal cliff. Combine this with 47 million Americans on food stamps and you need to ask yourself if this really sounds like an economic recovery.