...Since 2009 the annual CPI increases have been running around 2 percent. This might seem modest and nothing to fret about. Yet this is happening during a time when household incomes are stagnant. Given the massive amount of items that we import the impact is being seen from consumer goods, to food, housing, education, and healthcare. Yet when incomes are fixed, more and more money is consumed by the loss of purchasing power.

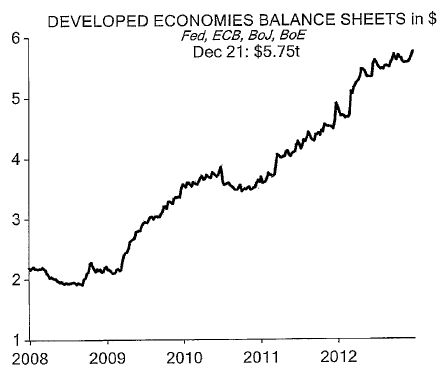

It would be one thing if this massive amount of central bank money printing were just common to the US but practically every major central bank around the world is following in the same footsteps:

This is a very important chart. It includes the balance sheet of the following central banks:

The Federal Reserve

European Central Bank

Bank of Japan

Bank of England

What you see is that central banks around the world have increased their balance sheets from $2 trillion in 2008 to nearly $6 trillion today. There is little doubt what path central banks are following. While households are deleveraging (losing access to debt/spending power) central banks have ramped up to aid their member banks.

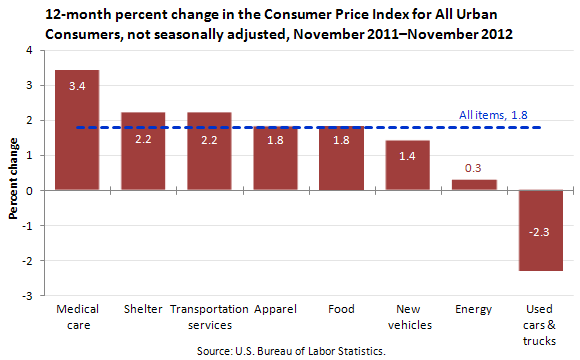

For most people it might be hard to see this in real daily terms. So let us examine inflation in a variety of sectors:

Take a look at what has been going up in price the fastest last year. The three sectors with the most inflation for the last year are medical care, shelter, and transportation. Food is also in the top five. These are all items that impact those on fixed incomes. And what about the 47 million Americans on food stamps? Any slight increase is going to take a deeper cut of the funds they are provided.

In the end, inflation is not a natural occurring event and even a little bit of inflation is problematic when incomes are stagnant.